Let's do a quick walk through the system.

Editor's Pick

Fundmanager.tools’ comprehensive comparative matrix of integrated front-to-back investment management systems (Order-, Portfolio- and Fundmanagement) crowns OCTOPUS as Editors' Pick, ahead of Simcorp, Bloomberg AIM, Xentis, Hedgeguard and FundCount.

No matter if your fund is just launched or if you've been managing it for a while: running an investment management business confronts you with a deluge of operational challenges and substantial costs.

Trading, Portfolio & Fund Management Systems are naturally at the core of professional investing. In this section we are reviewing six leading solutions where fund managers can expect pay anywhere from $32,000 to $1 million per year with additional set up costs ranging from $0 to $1-2 million.

Our comparative matrix benchmarks the contenders - Simcorp, Bloomberg AIM, Octopus, Xentis, Hedgeguard and FundCount - in 105 detailed features, visualizing similarities and differences between products and services.

The matrix also includes a Price-Performance evaluation which in combination with the feature list clearly designates Switzerland's Octopus as the winner and Editor's Pick, based on our current data. Please contact support@fundmanager.tools if you want to suggest or update features and/or data fields in the comparative matrix.

Pfäffikon, Switzerland based Finanzinformatik IT GmbH was founded in 2003 and launched Octopus in 2008. Octopus users appreciate the “fast implementation” and “maximum automation” capabilities that allows users to automate almost every task from imports out of external sources to sending reports.

We asked Octopus project manager Nathalie Ulken: “Did it surprise you that Octopus came out first and winning the Fundmanager.tools Editor's Pick designation?”

Nathalie Ulken, Project Manager

Nathalie Ulken: “We have been working on this product since 2008 and have continuously built and expanded its capabilities. Getting this recognition as Editor's Pick is really wonderful. To have industry data driven confirmation of our product is something we have been striving to achieve.

Our claim at Octopus is to be the only all-in-one, fully compliant Portfolio- and Fund management Web application that leading investment managers globally use to cover their entire workflow - without breaking the bank. We show that it's possible to deliver a superior product at the most competitive price. Given the reality where almost everything, particularly people and expenses for compliance, are only going up, it is an important and fundamental principle for our firm to be aligned with our clients and to give the best possible products and services to help them stay competitive.”

Fundmanager.tools: Who is your typical client?

Nathalie Ulken: “Our largest user base are hedge funds - remember that Octopus processes all instruments such as equity, bonds, and all derivatives: Futures, Options, Forwards. Many clients are regulated in one form or another, say they manage structures such as UCITS, AIFs or other types of funds. Here we are proud to completely cover all new regulatory requirements.

Fundmanager.tools: “Our comparative matrix lists 105 detailed features - which features or benefits would you say are the most important ones for fund managers to have in mind when checking out Trading, Portfolio & Fund management systems?”

Nathalie Ulken: “One fundamental quality a Trading, Portfolio & Fund management system should have the capability to cover the entire workflow. As your comparative matrix nicely demonstrates, Octopus has really taken the lead there. It's something only a few systems like Simcorp can do to a certain degree but at a much higher price point.”

Fundmanager.tools: “What other features or benefits of Octopus are you particularly proud of?”

Nathalie Ulken: “We created Octopus in one go as a true state of the art application, so it's not some sort of legacy system where engineers are busy patching new modules on and trying to expand it. Octopus is the only fully webbased system with VPN access from everywhere. Every client has his own virtual server, no local installation is necessary and there are no setup costs.

You can start instantly using it. The program is also quite easy to operate. It is intuitive and features help texts and instruction videos directly within the program.

No two fund managers are alike and so individual adaptations like limit rules or special reports are contained within our monthly fix prices. On top, individual interfaces can be added swiftly and without extra cost.

We have also heavily invested in our support. In fact, client feedback confirms an incredibly good support through features such as a chat support with no waiting time.

And finally, Octopus is hosted in the safest and biggest Data Center in Switzerland alongside other industry giants such as the Swiss stock exchange (SIX).

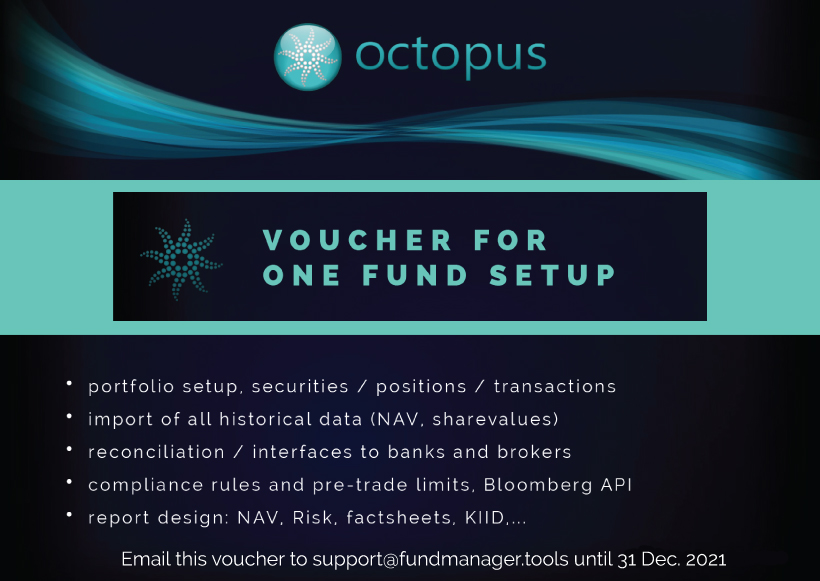

Fundmanager.tools: “That sounds all very convincing. I know you have put together a free offer valued at $2000 for people who are interested in working with Octopus or test driving it?

Nathalie Ulken: “Correct, we invite everyone to find out how much you can save, using a professional Trading, Portfolio & Fund management system!

Be one of the first 10 and claim your free 4 weeks test period for OCTOPUS along with a full fund setup

(valued at $2000).

Experience a seamless set up and integrated work flow:

- Setup your current portfolio including import of all securities / positions / transactions

- Import of all historical data (NAV, sharevalues)

- Setup reconciliation including all interfaces to banks and brokers

- Setup fund specific compliance rules and pre-trade limits

- Design of fund specific NAV report, Risk & Compliance report, factsheets and KIID + automated emails

- Setup EMSX API to trade directly in Bloomberg after compliance check

Included is the setup of your own dedicated server with secure VPN access from any of your machine. You will get a personal online training if required or you can watch the included training videos. One of your funds will be set up for you. You can test the full setup / reporting for up to 4 weeks without any obligations. The OCTOPUS team will sign a non-disclosure agreement at the beginning of the period and if you are not fully satisfied after the test period, all provided data and information will be deleted. On the other hand, if you want to go on using the system, this will be your life server and you can continue using it directly.

You'll see that transitioning to OCTOPUS will be easy and instantly improve your efficiency and work flow as well, and reduce costs.

Get in touch now, we look forward to hearing from you!

Fundmanager.tools: “Terrific! Fill out the form below to obtain the voucher for the fund set up - get it now as long as the vouchers are still available.

Thank you Nathalie and congratulations again on winning the Editor's Pick from Fundmanager.tools in the Trading, Portfolio & Fund Management Systems category.”

Get Your VOUCHER here 1 Fund Setup:

Set up your fund now for free:

Fill out this form now & get your voucher. Experience the power of Octopus, the leading integrated front-to-back investment management system:

-

Winner: Highest Evaluation Score (96%)

-

Winner: Best Price-Performance Ratio

-

Fundmanager.tools Editor's Pick

CONTACT

PHONE

Opalesque Support: +1 914 619 5223

(Monday through Friday from 9 AM to 5 PM GMT)

Matthias Knab: +49 89 2351 3055

Matthias Knab WhatsApp or Signal:

+49 170 1890077

ADDRESS

Opalesque Global Services LLC

244 Fifth Avenue Suite # G268

New York, NY 10001

U.S.A.

© Copyrights by OPALESQUE. All Rights Reseved.